Philanthropy has been at the heart of Christ’s since Lady Margaret Beaufort’s founding benefaction in 1505. Whilst the College has only had a Development Office for the last 25 years, the bedrock of our financial sustainability, the College Endowment, has been built up over centuries through careful and astute stewardship, but also through the generosity of benefactors from 1505 right up to the present day.

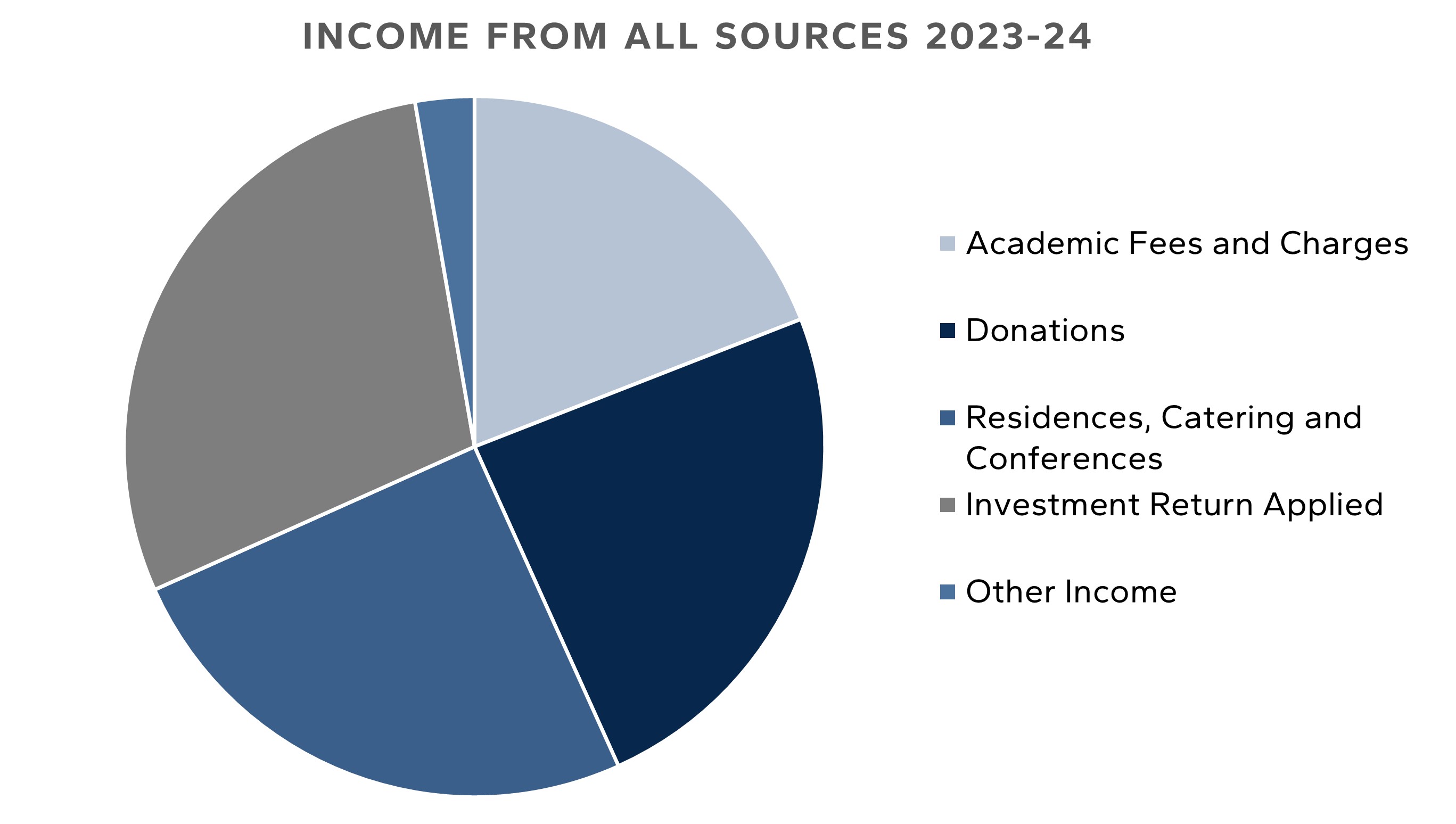

The annual distribution of the Endowment represents 30% of the College’s annual income. Traditionally, the remainder of the College’s income has been drawn from academic fees and accommodation, catering and conference income (from students and from commercial clients during vacations). Fundraising and philanthropy have, by and large, supported new buildings and capital spend, enabled us to grow the Endowment, or funded specific priorities such as additional means-tested bursaries or new Fellowship positions.

The picture has changed, however, in recent years. Tuition fees, despite the small, recent increase, have been effectively frozen since 2017 and since then, we have seen periods of sustained high inflation, as well as an increased need to invest in urgent building refurbishment, means-tested support for an ever-more diverse student body and crucial provision for our students, such as enhanced wellbeing support.

We currently receive half of each UK undergraduate student’s tuition fees (with the other half going to the University to fund faculty teaching). However, the cost of delivering the rigorous supervision-based education that distinguishes Cambridge from so many other universities is at least three times the fees we receive.

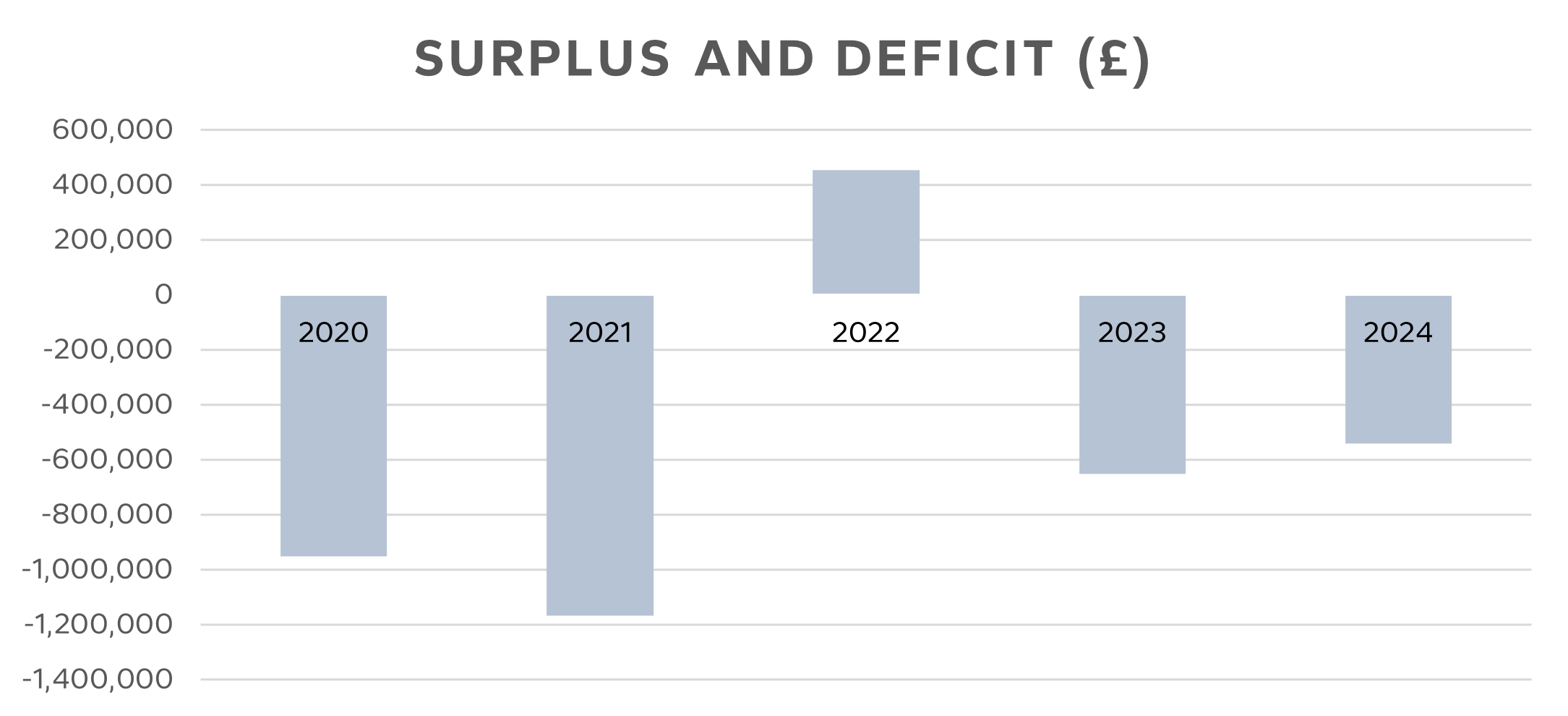

For the last 15 years, the College has generally been in a deficit position before donations. Fundraising is now, and will remain, a key part of our operational income, allowing us to deliver our core educational and academic aims. Funding our future ambitions, so that the College can continue to adapt, improve and thrive, will require even greater levels of philanthropic support from those who care about Christ’s and its future. Without fundraised income, the ambitions outlined in this document, which are so important to our future, will be unattainable.

Alongside increased fundraising, we are committed to responsible and diligent marshalling of our existing resources, through the expertise of our Investment Committee (now mostly alumni) in maximising Endowment income, by working hard to increase our income from conference and catering activities and by making the contribution we can from our available reserves (see below).

Many Colleges rely on long-term borrowing to finance capital expenditure, and indeed, Christ’s has done so in the past to enable previous developments (our long-term debt currently stands at £25m). Whilst we cannot rule additional borrowing out, our hope is to minimise the need for loans, given our focus on long-term financial sustainability in an increasingly volatile external environment.

Put simply, the College’s resources are insufficient to maintain its current ambition without donations, and this reliance on fundraising income is likely to continue, if not deepen, in the coming years.

Endowment

This is the College’s long-term investment portfolio that provides an annual distribution to the College that supports its operations. It is held in perpetuity, invested to maintain its real-term value for the benefit of future generations. It is managed completely separately from the College’s day-to-day or ‘operational’ finances.

The distribution from the Endowment to the College each year supports 40% of the College’s operating costs and thus the way it is invested and managed is critical to the success of the College and its ability to fulfil its charitable purposes.

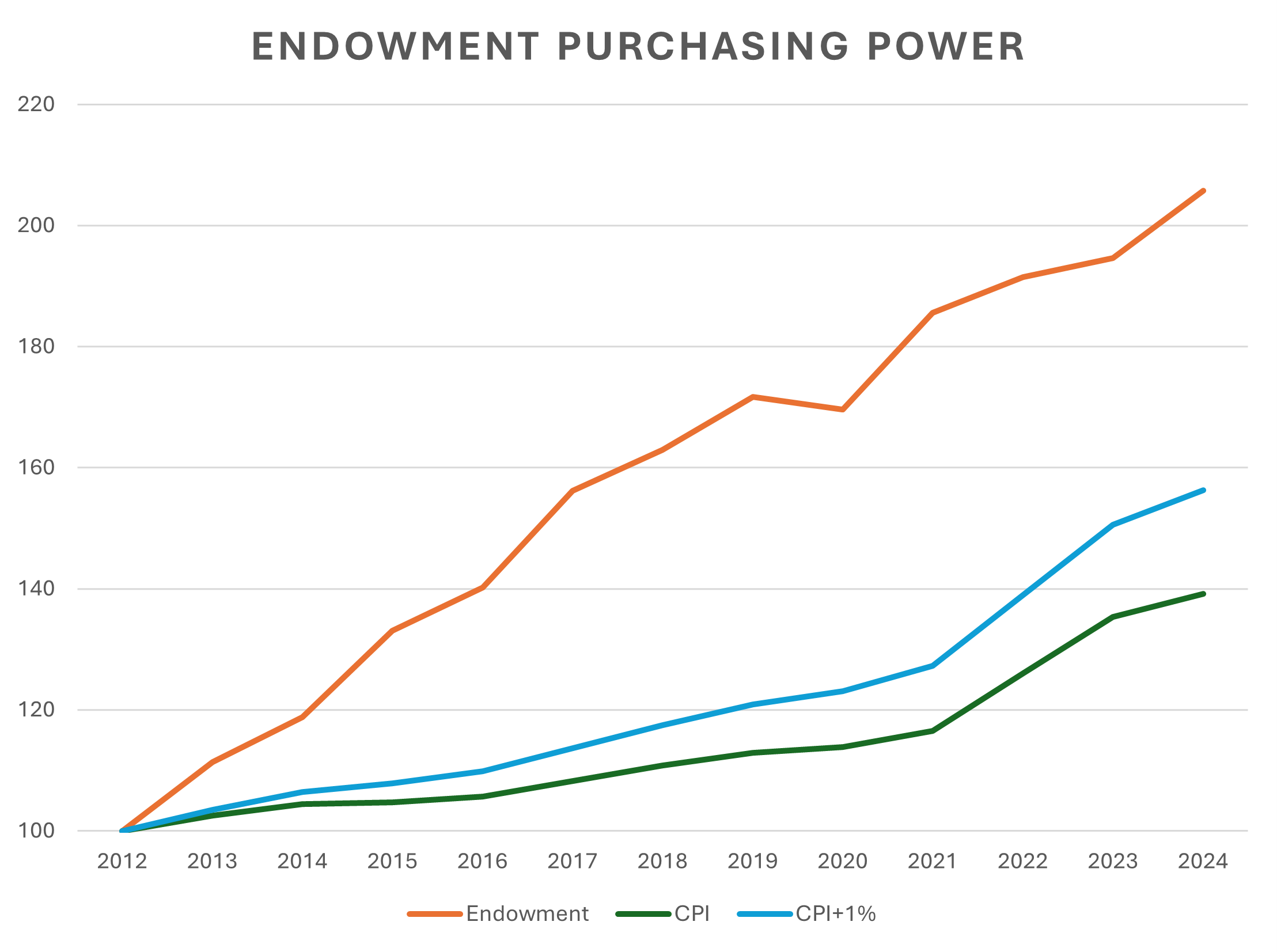

The two key investment objectives for the Endowment are: firstly, that it provides a sustainable and reasonably stable distribution to the College each year (currently 3.75% of Endowment value); and secondly, that the Endowment grows such that it at least maintains its real (i.e. inflation adjusted) value, with donations to the Endowment adding to Endowment value. In this way, the College can be ‘inter-generationally equitable’ i.e. achieve an appropriate balance between funding current and future beneficiaries.

This chart demonstrates that the purchasing power of the Endowment is being maintained over the long-term, though the consistently high inflation of recent years makes sustaining this increasingly challenging.

Given the College’s very long-term investment horizon, the Endowment is invested for total return and predominantly in ‘growth assets’ such as equities, private equity, property, infrastructure and private credit and with a significant allocation to illiquid asset classes. The College consequently bears investment risk and returns can naturally be subject to volatility, but this asset mix is appropriate for an institution with an effectively perpetual perspective.

Reserves

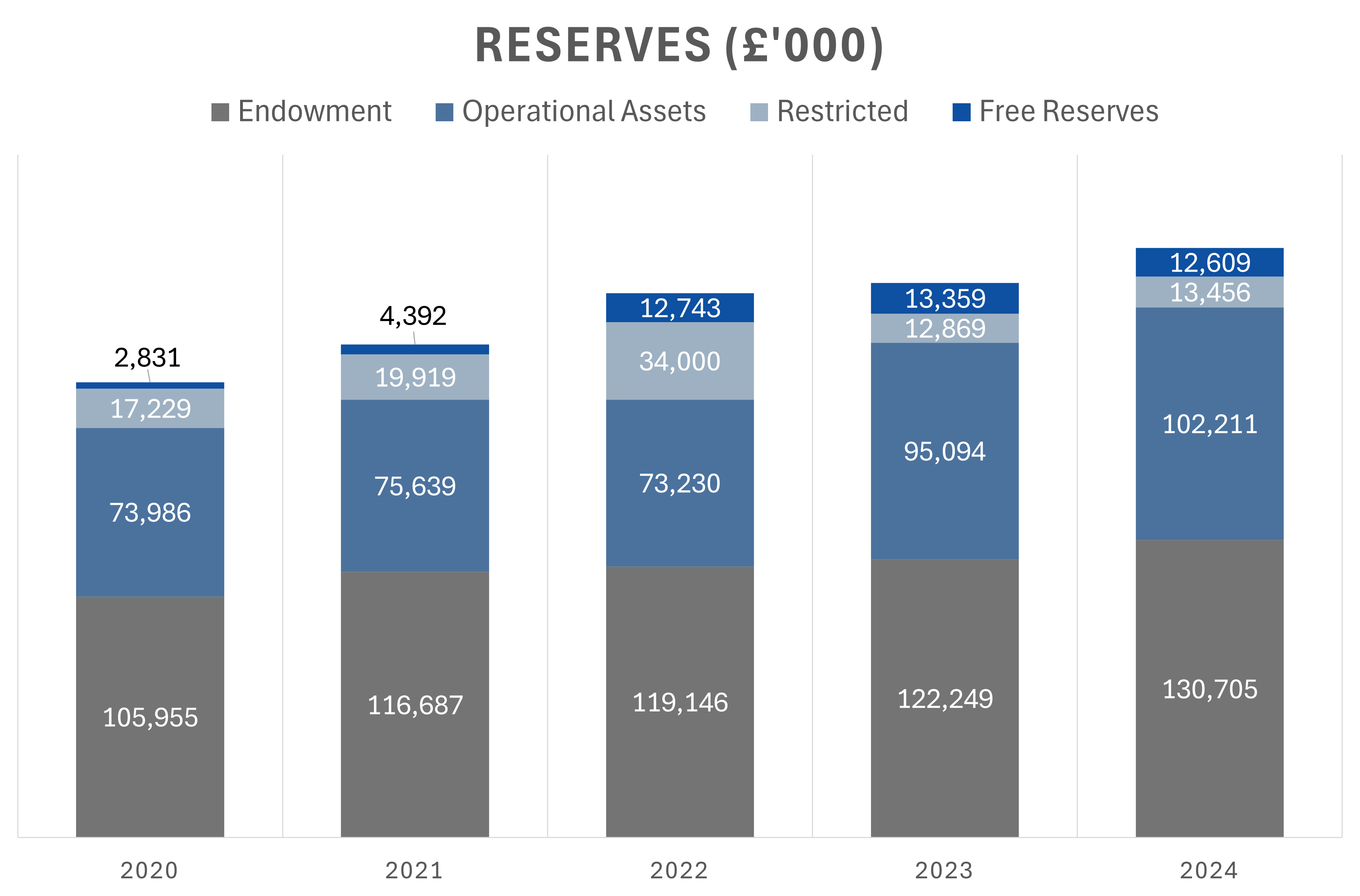

Despite a strong consolidated balance sheet at year end June 2024, as the chart below illustrates, the College’s free reserves represent a very small proportion of total reserves, with the bulk lying in the Endowment and in fixed assets such as the domus site:

Free reserves provide a level of working capital to protect the College’s core operations, funding for unexpected opportunities, and cover for risks such as unforeseen expenditure or unanticipated loss. The Trustees have set a target for free reserves to be equivalent to at least 6 months of operational expenditure

At year end June 2024, free reserves totalled £12.7m, which is approximately 9 months of College operational expenditure, so there is limited capacity for a contribution from reserves to our capital ambitions.